Ghana’s creation of a a 1.5% tax on cellular cash transactions in Might 2022 has been watched carefully by means of policymakers throughout Africa. The proponents of the digital transaction levy (e-levy) argue that taxes on cellular cash — repeatedly referred to in Ghana as MoMo — provide a possibility for cash-strapped governments to boost finances within the complicated post-pandemic context.

In Ghana, the “e-levy” has been related to the present management’s “Ghana Past Help” technique for lowering assist dependence.

Taxes on MoMo, in Ghana and in different places, have additionally been justified so as to “seize” the ones running within the casual financial system, who’re perceived as being untaxed. Critics have identified, on the other hand, that casual staff (who make up 89% of overall employment in Ghana) already pay a vary of charges and taxes. Subsequently they could also be disproportionately suffering from this new tax.

In spite of a lot hypothesis in regards to the affect of the e-levy, there was little empirical proof. Specifically, you will need to believe how casual staff in fact use cellular cash, how the levy impacts them and the way they understand it.

Our contemporary find out about seemed on the most probably affect of the levy on low and high earners within the casual financial system. It was once according to a consultant survey of two,700 casual sector operators – employers and own-account staff – in Accra ahead of the tax was once presented. We discovered that regardless of the minimal threshold shielding some customers, the tax most probably has a adverse affect on fairness. We additionally discovered that casual staff’ scepticism in regards to the tax was once rooted in issues about fairness and in distrust of the federal government extra extensively.

Contents

Assumption 1: e-levy will goal upper earners

One of the vital assumptions previous to the implementation of the e-levy was once that it could be an effective strategy to goal upper incomes segments of the casual sector. Those segments are perceived as being under-taxed and much more likely than lower-income earners to make use of cellular cash.

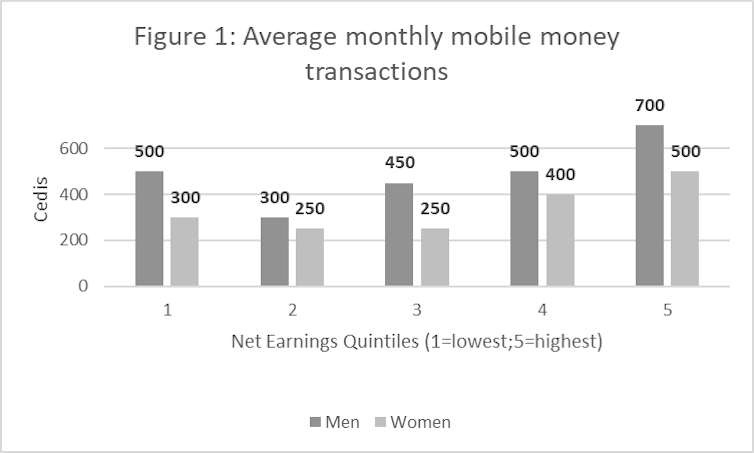

A key query, subsequently, is whether or not cellular cash utilization is targeted amongst upper revenue earners. This assumption simplest partly stands as much as the proof. We discovered that about part (51%) of the casual sector operators in Accra use cellular cash. It’s extensively utilized by men and women, by means of other occupational teams and around the income distribution. However the distribution of the particular per month transaction quantities is revealing (Determine 1).

As anticipated, the top-earning workforce (quintile 5) reported transacting probably the most at the MoMo platform (about 500 and 700 cedis for male and female staff, respectively). Then again, lower-income earners may also be suffering from the e-levy. It is because casual staff within the lowest incomes workforce transacted greater than the ones in different of the upper income classes.

About 41% of MoMo customers within the casual sector don’t have a checking account. Cellular cash transfers could also be in particular essential for the unbanked, who most often account for the decrease incomes and extra inclined segments of the group of workers. We discovered 43% within the lowest incomes quintile had financial institution accounts when put next with 54% within the best incomes quintile.

Assumption 2: apart from small transactions will make the levy honest

It was once expected that the exemption for transactions under 100 cedis in step with day would defend lower-income earners. It was once anticipated to restrict the adverse affects of the tax at the deficient.

According to MoMo utilization information, we have been ready to estimate e-levy legal responsibility in keeping with whether or not cellular cash transactions within the earlier month exceeded the 100 cedis threshold. Sixty-one % of the customers reported that they might be responsible for some quantity of e-levy fee according to their previous MoMo transaction patterns and quantities. Right here, our effects supply some strengthen for the federal government’s advice that the edge would offer protection to about 40% of MoMo customers from taxation.

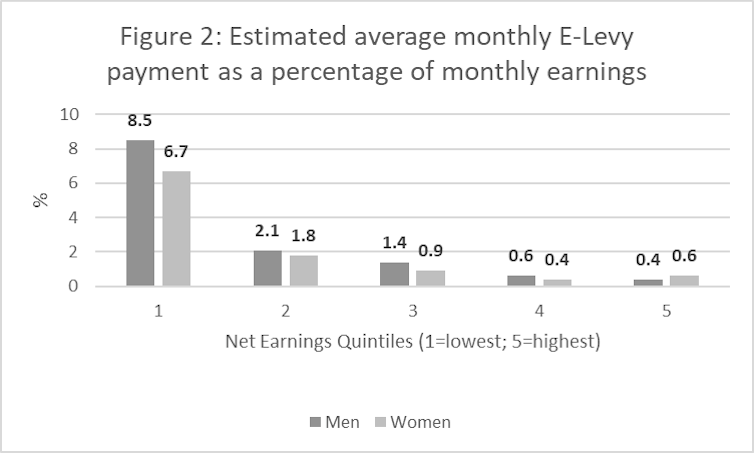

Then again, when the cellular cash transaction quantities over the edge are calculated as a proportion of income, it’s transparent that the levy continues to be a extremely regressive tax (Determine 2) – that means the tax burden is best at the lowest earners.

Decrease earners undergo a disproportionate proportion of the levy. The tax would account for simply over 8% and six% of per month income for women and men, respectively, within the lowest incomes quintile. A few of the height incomes quintile, by contrast, the projected tax could be lower than 1% of income for each men and women.

Assumption 3: strengthen for the e-levy would range on political traces

As different surveys have highlighted, the e-levy is very unpopular in Ghana. We discovered that 83% of Accra’s casual staff disapproved of it. They anxious about how it could have an effect on the deficient, that it could be unfair, or carry an already top tax burden.

The levy was once the topic of verbal or even bodily fights in parliament between the 2 primary events. The New Patriotic Birthday celebration management blamed public opposition to the levy on alleged propaganda by means of the minority Nationwide Democratic Council. This may recommend that strengthen for the levy would widely fall alongside birthday party traces. Our find out about discovered that supporters of the New Patriotic Birthday celebration have been certainly much more likely to strengthen the levy. However simplest 32% of them authorized. General, perceptions of the federal government and its efficiency influenced critiques at the levy.

We additionally discovered that ladies have been extra essential of the e-levy, even if we managed for a variety of demographic and political options. Handiest 12% of ladies authorized of it, when put next with 21% of fellows. This hanging distinction highlights the significance of additional analysis on this house, in particular to discover the relative affects on women and men.

Implications for coverage

The designers of Ghana’s e-levy argued that it could result in a greater distribution of the tax burden by means of bringing ostensibly untaxed casual sector staff into the tax internet (equity) whilst shielding the poorest (fairness). Whilst the edge is a hit in shielding some decrease revenue customers, we discovered, the e-levy continues to be extremely regressive.

Our proof means that the edge must be raised and frequently adjusted for inflation. Extra typically, earnings government must center of attention on different ways of taxing top revenue staff within the casual financial system, together with pros. On the very least, revenues from the e-levy must be utilized in some way that offsets its distributional affects. This is able to imply focused on new spending on public infrastructure, items and services and products that get advantages casual staff. Govt may just additionally subsidise premiums paid by means of casual sector staff to enroll in the Nationwide Well being Insurance coverage Scheme or contributions to the Nationwide Pension Scheme.

Our information means that key selections about coverage design and implementation have been based on assumptions that don’t seem to be sponsored by means of empirical proof. Persisted analysis at the affects of the e-levy within the coming months and years will assist be sure that policymaking is evidence-based, with a extra whole figuring out of the way the levy impacts voters and staff.

Supply Through https://theconversation.com/new-data-on-the-e-levy-in-ghana-unpopular-tax-on-mobile-money-transfers-is-hitting-the-poor-hardest-189671